The idea of klarna – an app providing the service of “buy now pay later” was introduced by the team which was dismissed by the judge in Stockholm in 2005 stating that the idea would never work and if it did, the banks would do it themselves.

But as we can see, the immense success the application has gained in the past few years with the same idea.

The application has 147 million active users and is in the list of top 3 BNPL apps. The biggest mobile app development service provider in all of the USA.

Let’s have a thorough look at the business and revenue model of the application and much more!

What is Klarna?

Klarna is a buy now pay later application developed with the advanced financial technology offering financial services which includes installment payments, direct payments, and payment after delivery options are available on the app.

The Klarna’s Business Model is the buy now pay later giving consumers the freedom to use products they like and pay later and not at that very instant.

The application works in a way that you can make the payment in 30 days or if you want to make the payment in installments, pay in 4 installments without any additional interest. One can make the payment using the Klarna app, paypal, or bank transfer.

Furthermore, the Klarna application also gives a financial program for upto 36 months for customers who want to make larger payments.

Other than this, there are certain platforms that provide in-store payments, Klarna is the most utilized platform for e-commerce.

Klarna: Facts & Statistics

- Founded in: 2005

- Headquarter: Stockholm, Sweden

- Founders: Evgenii Kondratev, Niklas Adalberth, Sebastian Siemiatkowski, Victor Jacobsson

- Business Model: Payment Solution for e-commerce

- Total active consumers: 150,000,000

- Total number of merchants: 500,000+

- Number of transactions per day: 2,000,000

- Number of employees: 5,000+

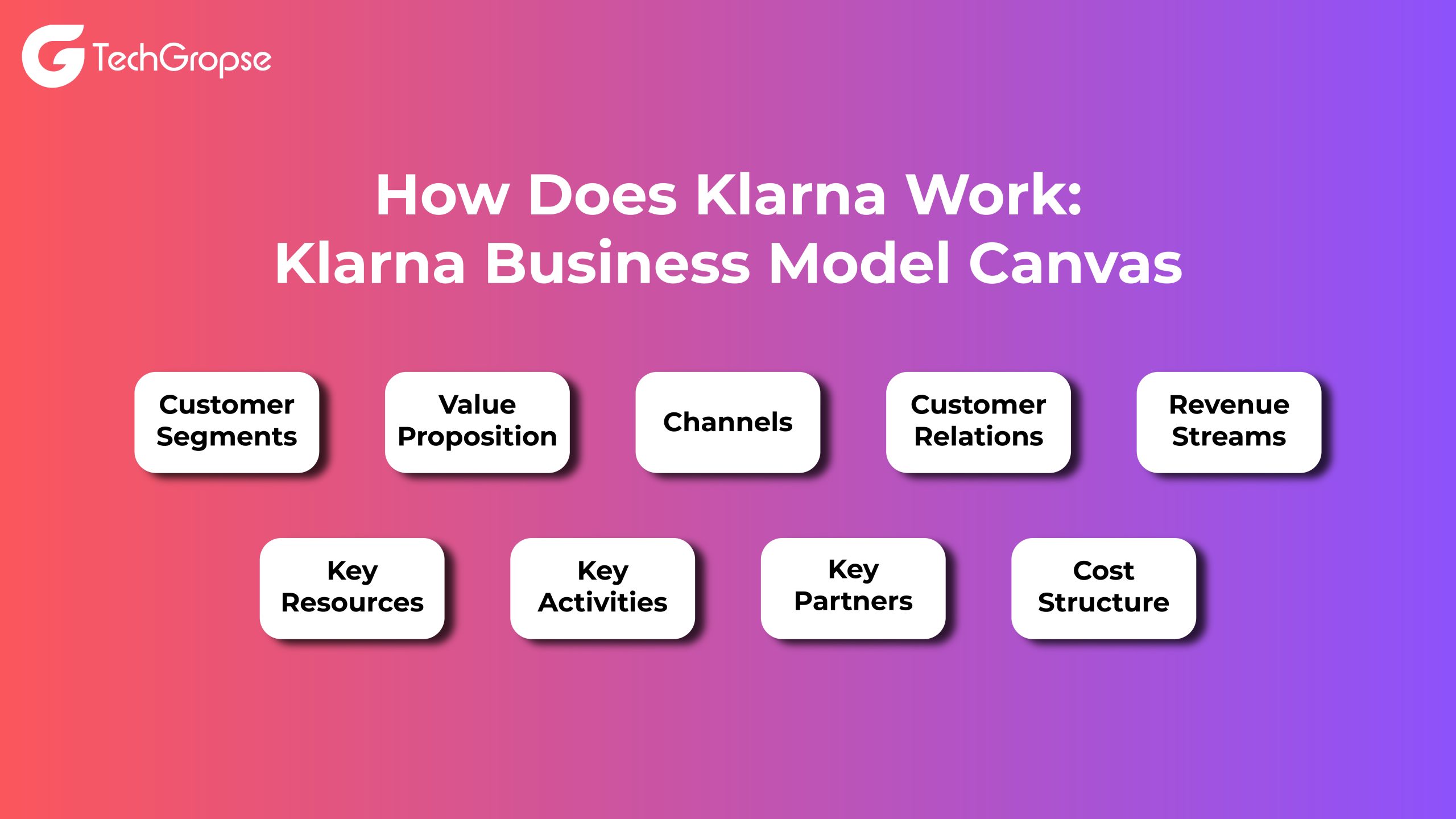

How Does Klarna Work: Klarna Business Model Canvas

Customer Segments

– While targeting the audience, make sure that you are directing online shoppers and ecommerce retailers.

– The customer demographics ranges from small local businesses to larger international enterprises.

– Top tier brands and businesses get in contact with Klarna as customers need a higher level of flexibility while buying things.

Value Proposition

– Online shopping experiences for consumers have been simplified with the convenience of a one-click checkout process.

– The Klarna app offers different payment options such as buy now pay later, payment after delivery and EMIs without interest.

– Customers can make the purchase of products without worrying about the payment or businesses as they can boost sales and minimize cart abandonment.

Channels

– The shop now pay later on Klarna app is operated with the help of mobiles, web, and API integrations with specific e-commerce platforms.

– The application makes sure that the payment process is easy, efficient and user-friendly amongst users and businesses.

– The Klarna card and app aligns with the services that are offered by the company website and social media pages.

Customer Relations

– The Klarna app focuses on making strong relationships with their customers.

– They maintain an user-centric approach to address the important concerns of the customers.

– They provide personalized assistance to the customers through the Klarna customer service number, chat, emails, or they are also available on social media platforms such as Facebook and Twitter.

Revenue Streams

– Both the consumer and the merchants are gaining benefits through the application by allowing them to make one time payments.

– The merchants using the app are liable to make a fee of 1.5-3% per transaction their consumers make through the application.

– The merchants have to make monthly payments in order to access the higher level of features.

– The customers who are using the a particular payment method as their default setting on Klarna may be subject to pay some fees primarily charged to the users.

Key Resources

– The app leads the shop now pay later market through expertise in the industry, customer data, advanced technology, and creating relationships by collaborating with the ecommerce platforms.

– Their strategy and expertise has taken the Klarna app on a higher level in the global market.

Key Activities

The application performs some key activities such as daily transactions, business partnerships, credit risk assessment, fraud prevention, eCommerce platform development and customer support.

Key Partners

– The platform has over 60000 partner globally renowned brands for the BNPL platforms to operate.

– By partnering with businesses such as Amazon, Klarna has reached a wide audience around the globe in the BNPL services to operate.

– The application has expanded their market and entered the Asian market by partnering with Alipay.

Cost Structure

– The Klarna app has managed the both ends of the customer and the merchant payment transactions. Therefore, they ensure that the management is effective in loan and credit risks.

– Klarna has cost related infrastructure maintenance, customer support, technology department, marketing, legal compliance, and salaries.

Also Read: How To Build An eCommerce App: A Step By Step Guide?

How Does Klarna Make Money?

The buy now pay later finance app is operational and execution methodologies together the four main revenue streams enabling them to attract funding. These are the following streams –

1. Fees/Commission from Merchants

The Klarna’s income comes from the fees of the merchant. A commission is implied by the company on each transaction made by the person and is handled through the use of the platform.

The commission percentage is determined by the country and payment method used by the merchant. The percentage of the entire transaction amount varies from 3.29% to 5.99%. Moreover, the fixed cost for each transaction is $0.30.

Users are offered with multiple payment options on the Klarna Platform. This includes the payment to be done in 30 days, card payments and finance plans such as 6,12,24, and 36 months.

However, there are no charges like monthly fees, setup fees, or minimum volume commitment from merchants.

2. Interest Rates

If a customer chooses finance from Klarna for large purchases then the app will charge up to 19.99% APR for a period of up to 36 months. The interest amount rate differs from customer to customer depending upon their credit score. The customer does not pay any type of interest when they are choosing the Klarna’s pay for 30 days or in four installments payment options.

3. Late Payment Charges

The late payment charges from the users are the ones who miss or delay in making payments on time. This encourages the user to make on time payments and economical purchases. The late fees is divided into different categories and calculated according to the table given below –

| Total Order Value | Fee per Late Repayment | Maximum Late Fee per Order | Snooze Fees |

|---|---|---|---|

| $0-24.99 | $0 | $0 | $0 |

| $25-59.99 | $2 | $6 | $1 |

| $60-99.99 | $4 | $12 | $2 |

| $100-199.99 | $6 | $18 | $3 |

| $200 and above | $8 | $24 | $4 |

One thing to keep in mind is that the Klarna app is responsible for paying the merchant any unpaid balances even if the customer is neglecting to make the payment.

4. Klarna Card Transactions

Klarna card generates revenue through virtual cards which makes it accessible to the customers. By using this card, the customer can make in store purchases in retails stores that are in collaboration with Klarna.

Many customers have linked their virtual cards making it accessible to the customers. The virtual card can be linked with Google or Apple wallets. This helps in enabling swifter payments once the budget is created for the merchants and retailers.

The primary revenue stream of late payments to the customers are in default. But the way the functioning of the card works, it makes it possible for the fintech development company to significantly raise the amount of merchant commissions. Customers can use the Klarna Card at a number of well-known stores, such as H&M, Nike, IKEA, The North Face, GameStop, Sephora, and Foot Locker.

5. Interest on Cash

Other than the ones mentioned above, there is one more way to generate revenue on the application. This includes interest on cash. Like many businesses, the Klarna has interest on cash on the funds stored in the banks.

Interest on cash cannot be seen as a substantial source of income as the interest rates offered are lower, hence this is not the main component of the Klarna business model.

SWOT Analysis of Klarna Business Model

Let’s discuss the SWOT analysis of the Klarna app –

Strength

There is a very huge demand for brand services amongst customers. The Klarna platform offers a certain payment platform for their users. Adding to it, with their advanced technology of banking software, Klarna stands at the top. Also, provides risk features.

Weakness

The user has control over Klarna because of the business model. A higher rate of payment can help in significantly impairing the franchise’s financial position.

Opportunities

The app is active in 10 countries only. They still have a way to go to reach the users on a higher global scale.

Threats

There is a high number of demand in the market where Klarna operates. The threat is the growing number of competitors in the market.

Final Thoughts

The advancement of technology is really important for the business to grow and make their space in the competitive market. Klarna is an application doing exactly the same by integrating modern technology and transforming the Fintech sector with their development. Klarna’s business model has earned high valuations for the past few years, and the company has come far from that. The marketing strategy followed by the business is to partner with brands and offer services to them as a payment option in different ways. This has been of help for the company for them to grow rapidly and is now known to be one of the leading payment providers. The company reinvests profits to expand their competition in the market.

Build an App Like Klarna Business With TechGropse Mobile App Development

A mobile application like Klarna can be developed only through a company that is strong in terms of communication and their skills. TechGropse leads the market as a mobile app development company with our designers and developers performing up to the mark. We stay ahead of the competition by creating strategies according to the application and business requirements. We integrate advanced technology in our applications adding features and strengthening the user experience with their expertise.

FAQs

- Will Klarna Impact Credit Score?

Using Klarna can impact your credit score, but it depends on the type of financing you choose. Klarna offers "Pay Later" and "Pay Now" options, which typically do not affect your credit score. However, opting for their financing plans, such as "Slice It," involves a credit check, which may influence your credit score. Late or missed payments on financing plans can also negatively affect your credit score.

- What are the Benefits of Klarna for Merchants?

Klarna offers several benefits for merchants, including increased sales and conversion rates by providing flexible payment options to customers. Merchants can attract more customers who prefer paying later or in installments. Klarna handles the credit risk, ensuring merchants receive full payment upfront. Additionally, Klarna provides a seamless checkout experience and detailed analytics to help merchants understand customer behavior and improve their sales strategies.

- Is Klarna Safe and Secure?

Yes, Klarna is safe and secure. It uses advanced security measures, including encryption and fraud protection, to safeguard users' personal and financial information. Klarna is also regulated by financial authorities in the countries it operates in, ensuring compliance with industry standards. While no system is completely foolproof, Klarna's commitment to security helps protect users from potential threats and unauthorized transactions.

- What are the Competitors or Alternatives of Klarna?

Competitors and alternatives to Klarna include Afterpay, Affirm, PayPal Credit, and Sezzle. Afterpay offers interest-free installment payments, similar to Klarna's "Pay Later" option. Affirm provides transparent financing with no hidden fees. PayPal Credit offers flexible payment options within the PayPal ecosystem. Sezzle is another buy now, pay later service with interest-free installments, appealing to similar customer segments as Klarna.

Hello All,

Aman Mishra has years of experience in the IT industry. His passion for helping people in all aspects of mobile app development. Therefore, He write several blogs that help the readers to get the appropriate information about mobile app development trends, technology, and many other aspects.In addition to providing mobile app development services in USA, he also provides maintenance & support services for businesses of all sizes. He tried to solve all their readers’ queries and ensure that the given information would be helpful for them.